Remote area tax concessions and payments

Study report

Released 26 / 02 / 2020

This report looks at the effects of the zone tax offset, remote area allowance and remote area concessions for fringe benefits tax on people and businesses in remote areas. The report makes recommendations on whether these remote area tax concessions and payments should continue and, if so, what form they should take.

Download the overview

Download the report

- Remote area tax concessions and payments - Study report (PDF - 4821 Kb)

- Remote area tax concessions and payments - Study report (Word - 9888 Kb)

- At a glance

- Contents

Key points

- Remote area tax concessions and payments are outdated, inequitable and poorly designed. They should be rationalised and reconfigured to reflect contemporary Australia.

- Remote Australia has changed considerably since the introduction of the first of these concessions in 1945. Many areas once considered isolated are no longer so, and improvements in technology have reduced the difficulties of life in remote Australia, although to a lesser extent in very remote places.

- About half a million Australians live in remote areas far from cities and regional centres. The tyranny of distance makes living and doing business challenging, with many things taken for granted by most Australians unavailable or difficult to get. Yet for those in remote Australia there is frequently a strong personal or cultural connection to a place and community as well as to the way of life it offers. Others are attracted by job opportunities.

- The zone tax offset (ZTO), remote area allowance (RAA), and fringe benefits tax (FBT) remote area concessions are designed to redress some of the inherent challenges of living in, or to support, parts of regional and remote Australia.

- The ZTO - a small tax concession available to residents of specified areas - is outdated. As it currently operates, it is poorly-targeted, and ineffective as a magnet for remote living.

- It lacks a compelling contemporary rationale, and should be abolished. In many cases, higher remuneration for jobs in remote Australia compensates workers, at least to some extent, for the disadvantages of remote living.

- If the ZTO is retained, only those people living in very remote areas should be eligible.

- The RAA is a supplementary payment for people on income support in remote areas. It partially compensates for higher living costs. The majority of recipients face socioeconomic disadvantage and barriers to mobility. Being out of the labour market, RAA recipients do not

benefit from the remuneration premiums that apply to ZTO recipients.

- The RAA has a legitimate role — it can serve to partly compensate people on income support for higher living costs and less ready access to services. But it needs a refresh — with boundaries set around very remote Australia only and payment rates reviewed.

- FBT concessions for remote areas have dual objectives: equitable tax treatment where employers have operational reasons to provide goods and services to employees; and regional assistance goals.

- The most compelling argument for these concessions is the former. But current concessions are overly generous and complex, thereby creating other inequities. By virtue of their broad application, they are ineffective in supporting service delivery needs and regional development.

- The concessions should be redesigned to be more tax neutral. This would reduce the scope for differential tax treatment to distort investment decisions — delivering more efficient outcomes and generating tax revenue that could be used for other priorities.

- Most significantly, the exemption for employer-provided housing should be changed to a 50 per cent concession (as it was prior to 2000), and provisions allowing employers to claim housing exemptions solely because it is ‘customary’ should be removed.

- In looking at alternative mechanisms to support regions, governments should be cautious of top-down approaches. While there are few one-size-fits-all solutions, harnessing existing capabilities and locational advantages should be at the core of any such strategy.

Media release

Remote area tax concessions and payments

The Productivity Commission has released its final report into three longstanding tax concessions and payments for remote areas.

The Australian Government asked the Commission to review the zone tax offset (ZTO), the remote area allowance (RAA) and fringe benefits tax (FBT) remote area concessions.

Australia has changed considerably since these concessions were introduced. Once small and isolated towns, Cairns, Darwin and Townsville have become large connected regional cities, and technology has reduced many of the difficulties of remote living.

After extensive consultation and analysis, the Commission recommends abolishing the ZTO and updating the remote area allowance and FBT remote area concessions.

The report found that the ZTO no longer serves a purpose in contemporary Australia, and is not needed. Removing what is now a small payment will not have a large or long term effect on the economies of those areas affected.

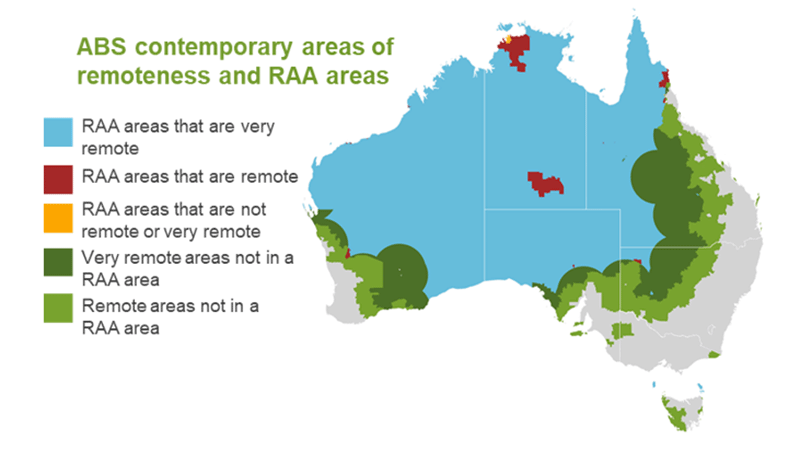

If the ZTO is retained the boundaries should be updated according to contemporary Australian Bureau of Statistics (ABS) classifications, and only those people living in very remote areas should be eligible.

The RAA should be better targeted. The report found that this allowance can help to alleviate the higher living costs and less ready access to services that many income support recipients in very remote communities face. The majority of RAA recipients in these areas face socioeconomic disadvantage and significant barriers to mobility.

FBT concessions for remote areas are overly generous, costly and inequitable and should be tightened. As broad-based concessions, they are poorly targeted to regional development and lack transparency.

There are more effective policies and programs that address regional and remote needs such as funding of public services including education and health, provision of infrastructure and natural disaster recovery funding. These policies and programs are funded by all levels of government.

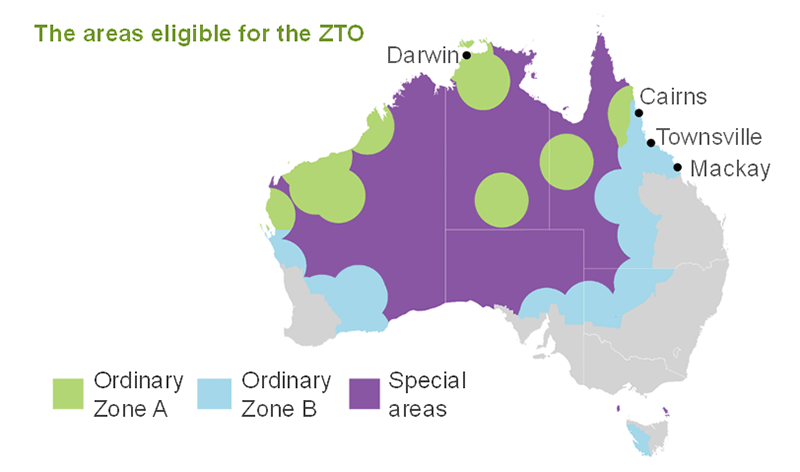

The zone tax offset (ZTO) is an income tax offset available to residents of specified parts of Australia (referred to as the ‘zones’ — see figure). It is designed to compensate residents for harsh climatic conditions, isolation, and a higher cost of living in the zones. The precursor to the ZTO was put in place in 1945.

In 2016-17 about 480 000 taxpayers claimed the ZTO, with claims worth $153 million. Many claimants earn above-median incomes.

Payment rates

There are three rates available, with people in more remote areas eligible for a larger offset.

- Special areas: $1173 offset, plus 50 per cent of applicable dependant rebates.

- Ordinary Zone A: $338 offset, plus 50 per cent of applicable dependant rebates.

- Ordinary Zone B: $57 offset, plus 20 per cent of applicable dependant rebates.

ZTO rates have not increased since 1993-94, and the value of the offset to claimants has fallen significantly in real terms. Today, the ZTO represents less than 1 per cent of after-tax income for more than 80 per cent of claimants.

The zones are outdated

The zones are outdated. Nearly half of claimants live in Townsville, Cairns, Darwin, or Mackay, which are now well-developed and connected cities. Their residents can no longer be considered isolated.

The ZTO lacks a contemporary rationale

Arguments in favour of the ZTO generally fall in one of two categories.

One argument is that it is necessary to compensate residents for the disadvantages of life in remote areas. However, Australians face a range of advantages and disadvantages wherever they live, and will typically locate themselves to the area they value most highly. And in many cases, higher remuneration for jobs in remote Australia compensates workers, at least to some extent, for the disadvantages of remote living.

The second argument is that the ZTO should support regional economic development, including by encouraging people to relocate to particular areas. A tax offset is not well suited for encouraging people to move to particular areas, because the employment opportunities, liveability and amenities available in particular places tend to play a more important part in where people decide to live and work. Further, attempts by governments to create an artificial advantage for a remote community, or to attract people to live in high-cost areas through tax concessions, are unlikely to be effective and typically result in net losses to the broader Australian community.

The Commission does not consider that either argument justifies maintaining the offset.

What is the Commission proposing?

As it stands, the ZTO is ineffective and poorly targeted, and the Commission does not consider that there is a compelling, contemporary justification for it to continue.

The ZTO should be abolished. In most cases, this is likely to have a small or modest impact. For the majority of recipients, including residents of Cairns and Townsville, the average impact will be around $2.50 per week.

If the Australian Government decides to retain the ZTO, it should be reconditioned. The ZTO should only be available to residents of very remote areas (as defined by the ABS) and provided as a flat offset at the current special area rate ($1173).

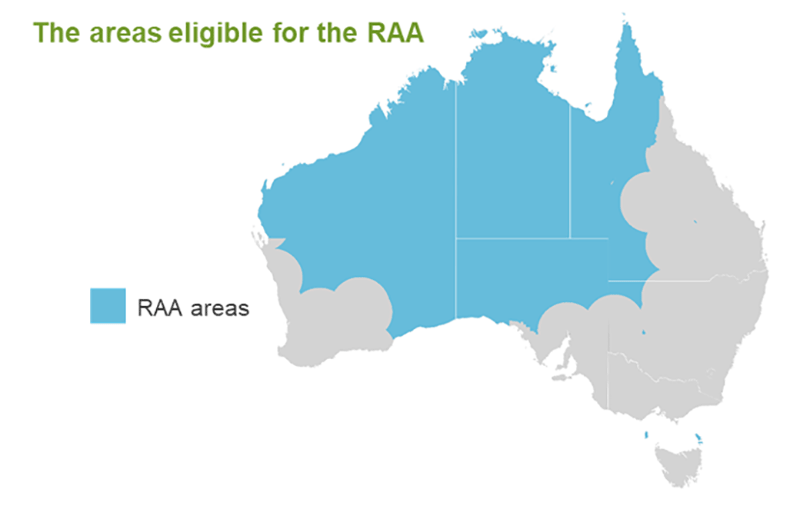

Introduced in 1984 as a companion payment to the zone tax offset (ZTO), the remote area allowance (RAA) is a supplementary payment for income support recipients in eligible areas. This study is the first broad-based review of the RAA since its introduction.

The Australian Government spends $44 million on the RAA each year, reaching over 113 000 people. Fortnightly payments are $18.20 for a single recipient, $15.60 for each person in a couple and $7.30 for each dependent child. The average RAA payment per recipient is $387 a year.

RAA areas include special areas and ordinary Zone A (but not ordinary Zone B), as defined in taxation legislation for the purpose of the ZTO (map below).

Some notable characteristics of remote area allowance recipients

- Most RAA recipients reside in very remote and remote areas of Australia (as defined by the Australian Bureau of Statistics remoteness classification).

- The majority are located in the Northern Territory, with one in five Northern Territorians over the age of 15 years in receipt of the payment.

- Half are located within areas of the highest socio-economic disadvantage.

- Two thirds of recipients are Indigenous Australians.

- The large majority are in receipt of either the age pension, the disability support pension, Newstart allowance or parenting payment.

- Just over half have been in receipt of an income support payment for over five years.

The RAA has a policy role...

The Commission considers that the RAA has a legitimate role — to compensate for some of the higher costs of living and reduced access to services affecting income support recipients in remote areas.

Unlike for most ZTO recipients, there is no market mechanism to compensate income support recipients in remote areas, who are predominantly outside the workforce, for the disadvantages of living in remote places. This, together with limits on the mobility of many RAA recipients (relative to ZTO beneficiaries), provides a policy basis for a supplementary income support payment like the RAA.

... but is in need of a refresh

RAA areas are outdated and payment rates have not increased in 20 years.

To ensure that the RAA is fit-for-purpose in contemporary Australia, the Commission is recommending that RAA areas be aligned with very remote areas, as classified by the Australian Bureau of Statistics (map below). Relative to people in remote areas, people in very remote areas face higher living costs, less ready access to services, and greater barriers to mobility. There are also significantly higher levels of socioeconomic disadvantage and lower levels of adaptive capacity in very remote areas.

Aligning RAA boundaries to very remote areas would improve the RAA’s targeting, decrease the number of recipients (over a year) by 46 000 and, if current rates of payment were maintained, decrease the cost of the RAA by $18 million a year.

The Commission is also recommending that the Australian Government should initiate a process to set new payment rates for the RAA.

Under Australia’s fringe benefits tax (FBT) regime, employers may claim tax concessions for some goods, services, or financial assistance provided to employees working in designated remote areas.

These remote area tax concessions may apply to:

- housing provided by an employer as an employee’s usual place of residence

- financial assistance with housing sourced by an employee

- residential fuel, for use in properties where the remote area housing concessions are used

- meals for primary production employees

- holiday transport for employees

- transport to and from a worksite for fly-in fly-out (FIFO) workers.

Some additional exemptions, on temporary accommodation, meals and (in some cases) transport for FIFO workers, are not restricted by FBT remote area definitions.

There are two main types of concessions: exemptions (where the good or service is not subject to FBT), and partial concessions (where the taxable value of the good or service is reduced, often by 50 per cent).

The concessions can provide significant tax savings

The exemption for employer-provided housing (as usual place of residence) can provide significant tax savings to higher-income employees in particular, and could cost as much as $390 million per year in forgone FBT revenue. Use of the exemption is concentrated in northern Western Australia and Queensland, and in industries such as mining, agriculture, and public services.

Partial concessions on employee-sourced housing are less generous and have higher compliance costs than the exemption for employer-provided housing; the other remote area concessions (on residential fuel, meals for primary production employees and holiday transport) provide limited tax savings and have high compliance costs. These concessions are narrowly used.

The concessions are overly generous and go beyond what is needed to make the tax equitable

Stakeholders differ on the concessions’ policy objectives. Some maintain that the concessions should promote regional development by giving employers greater financial capacity to attract and retain employees.

Another perspective is that employers sometimes have operational reasons to provide goods and services (such as housing) to employees, and in these cases it would be inequitable to apply the full rate of the FBT. The full rate of FBT is equivalent to the top marginal income tax rate, and would act to discourage the provision of remuneration ‘in kind’ instead of wages; employers in remote areas would be disadvantaged relative to employers in locations where employees could buy the goods and services themselves with their wage earnings. The Commission considers this to be the most compelling argument for FBT remote area concessions.

However, as they are currently designed, the FBT remote area concessions do not address either of their purported objectives effectively. The current concessions are overly generous and complex, which creates other inequities including artificial cost advantages for some businesses which, in turn, encourage inefficient investment.

What changes is the Commission proposing?

The Commission is proposing several changes to the concessions’ rates and eligibility rules (table below). In particular, for employer-provided housing, the current exemption should be changed to a 50 per cent concession, as it was prior to 2000. The boundaries for the concessions should also be updated to reflect current populations and contemporary road infrastructure.

What impacts would the Commission’s proposals have?

These changes would better target the remote area concessions to address inequities in the FBT regime where there is an operational requirement to provide goods and services (such as housing) to employees. This would help to limit use of the concessions where there is not an operational requirement, without penalising employers where there is.

The proposed changes would reduce tax savings and cause some increase in compliance burdens. The employment and regional effects are likely to be small overall. To provide time to adjust, the changes to the FBT remote area concessions should be introduced with a delayed start date.

There is a case for the Australian Government to consider providing some of the assistance it currently provides (non transparently) through the FBT concessions in other ways. If the Australian Government adjusts the funding of service delivery agencies, general revenue assistance paid to State and Territory governments would be an effective way of doing so.

The Commission is not proposing changes to the existing exemptions for fly-in fly-out (FIFO) arrangements. However, FBT exemptions for FIFO workers, while widely used, are likely to have only a minor influence on decisions to maintain a FIFO workforce. The significance of the one concession for FIFO workers that explicitly links eligibility to remoteness (transport to and from a work site) would be even less.

| Existing concessions | Proposed changes | |

|---|---|---|

| Employer-provided housing | Exemption from FBT for employer-provided housing in designated remote areas (FBTAA, s. 58ZC) |

|

| Employee-sourced housing | Partial concessions on other forms of housing assistance in designated remote areas (FBTAA, s. 60 and Divisions 14A, 14B) |

|

| Temporary accommodation, meals and transport for FIFO workers | Exemption from FBT for temporary accommodation, meals and transport for FIFO workers. (Note: remote area transport (s. 47(7)) is the only concession linked to remote area boundaries) |

|

| Residential fuel | Partial (50 per cent) concession for residential fuel used in housing that attracts an FBT remote area concession (FBTAA, s. 59) |

|

| Meals for primary production employees | Exemption from FBT for meals provided to primary production employees on work days (FBTAA, s. 58ZD) |

|

| Holiday transport | Partial (50 per cent) concession on return holiday transport to specified destinations. (FBTAA, s. 60A and s. 61) |

|

| Boundaries for the concessions | Based on 1981 populations and 1986 road distances. Different population thresholds apply in ZTO zone and non-zone areas. |

|

Collectively, Australian, State and Territory governments direct billions of dollars to measures intended to assist individuals, businesses and communities in, and facilitate the development of, regional and remote Australia. The remote area tax concessions and payments are a very small share of this.

Government measures supporting regional and remote Australia

State and Territory governments, with support from local governments, have primary responsibility for service delivery within their jurisdictions. The measures include:

- remote area (district) allowances to attract police, teachers and other professionals

- support for patients needing to travel long distances to access specialist medical services

- distance education.

In addition, initiatives extend to the funding of regional projects. One example is the Western Australian Government’s Royalties for Regions program — which directed over $6.9 billion of State mining and onshore petroleum royalties to over 3700 infrastructure and community projects.

The Australian Government also supports regional and remote communities, including through payments to doctors to work in remote areas, subsidies for the supply of some utility services like telecommunications, assistance for industries prominent in regional and remote areas, specific funds such as the Building Better Regions Fund and significant infrastructure investments (including regional airports). This is on top of Australia’s system of horizontal fiscal equalisation, which aims to give each jurisdiction the fiscal capacity to provide a similar level of public services, and considers the higher per capita expenditure on service delivery in remote areas.

Natural disaster relief

All governments have extensive involvement in the relief, recovery and reconstruction of communities devastated by natural disasters, such as the recent bushfires. The crux of this support is that it is targeted to the communities affected, wherever they are located.

Remote area tax concessions and payments are poorly suited for this purpose as they are small ongoing payments to people in a fixed geographical area — many parts of which will not be affected by a natural disaster — while other communities that are affected by natural disasters miss out. For example, most communities affected by the recent bushfires, such as those on the south coast of NSW, are in ‘regional’ areas, not ‘remote’ areas of Australia.

- Preliminaries: Cover, Copyright and publication detail, Foreword, Terms of reference, Contents, Abbreviations and Glossary

- Key points

- Overview

- The Commission’s approach

- Life in remote Australia

- The zone tax offset

- The remote area allowance

- Fringe benefits tax remote area concessions

- Alternative mechanisms to support remote Australians

- Draft recommendations and findings

- Chapter 1 About the study

- 1.1 Evolution of the remote area tax concessions and payments

- 1.2 Impetus for the study

- 1.3 The study’s scope

- 1.4 The Commission’s approach

- Chapter 2 Life in remote Australia

- 2.1 The changing face of remote Australia

- 2.2 How remote Australia compares today

- 2.3 Challenges of life in remote Australia

- 2.4 Why do people live in remote Australia?

- 2.5 Summary and policy implications

- Chapter 3 The broader policy context

- 3.1 Regional development policy

- 3.2 Assisting regional and remote communities

- 3.3 Measures affecting remote Indigenous communities

- 3.4 Industry-specific assistance

- 3.5 Summing up

- Chapter 4 The zone tax offset

- 4.1 What is the ZTO?

- 4.2 The ZTO’s origins and evolution

- 4.3 Who claims the ZTO?

- 4.4 How has the value of the ZTO changed?

- 4.5 Economic and employment effects

- 4.6 Effectiveness of the ZTO

- Chapter 5 The future of the ZTO

- 5.1 Is there a role for the ZTO in contemporary Australia?

- 5.2 If the ZTO were retained, what form should it take?

- 5.3 Tax concessions for businesses in remote areas

- 5.4 Alternative mechanisms to support remote Australia

- Chapter 6 The remote area allowance

- 6.1 What is the RAA?

- 6.2 A profile of RAA recipients

- 6.3 The economic impacts of the RAA

- 6.4 Is there a role for the RAA in contemporary Australia?

- 6.5 A refresh of current arrangements is needed

- Chapter 7 FBT remote area concessions

- 7.1 Operation of FBT remote area concessions

- 7.2 Use and economic effects of FBT concessions

- 7.3 Are FBT remote area concessions effective?

- Chapter 8 Improving the FBT concessions

- 8.1 Approach to assessing alternative options

- 8.2 Housing as usual place of residence

- 8.3 Other remote area concessions

- 8.4 FBT remote area boundaries

- 8.5 Implementation issues

- Appendix A Conduct of the study

- Appendix B The cost of living in remote Australia

- B.1 Methodology and data

- B.2 Overall price levels by zone and ABS remoteness category

- B.3 A closer look at individual expense categories

- B.4 The cost of living in the Northern Territory

- Appendix C Use and cost of FBT remote area

concessions

- C.1 Remote area housing as usual place of residence

- C.2 FIFO and DIDO arrangements

- C.3 Other remote area concessions

- C.4 Estimating the impacts on services

- References