Vulnerable private renters: Evidence and options

Commission research paper

This research paper was released on 25 September 2019. The paper examines the experiences of vulnerable people in the private rental market. It also discusses policies that affect outcomes for vulnerable renters.

Erratum: Several minor interpretation and calculation errors of historical Census data that were used to create figures 1 and 1.2 have been rectified following this paper. The correct data are contained the chart data (XLSX file) at the bottom of this page. Download the data

Download the paper

- Vulnerable Private Renters: Evidence and Options (PDF - 2098 Kb)

- Vulnerable Private Renters: Evidence and Options (Word - 1284 Kb)

Visual summary

Download the visual summary

- Key points

- Media release

- Contents

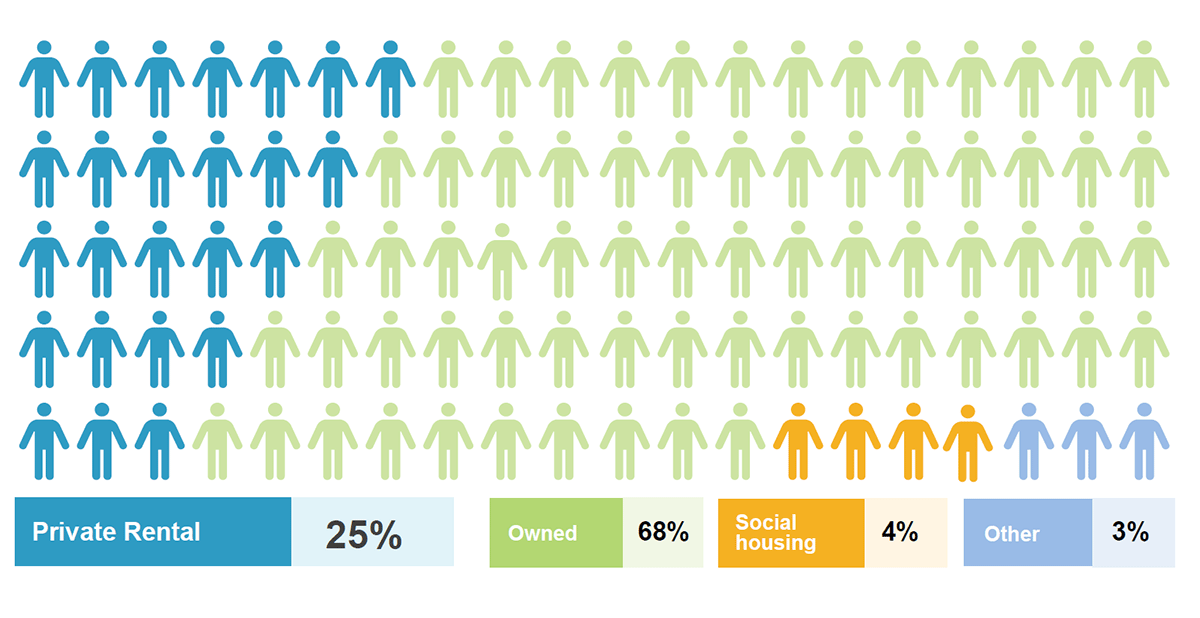

- Australia's private rental market works well for most people, most of the time. The market has adapted to a fast-growing population as well as to several structural shifts — stemming from the coincident rise in house prices as well as to the declining availability of social housing.

- These forces have culminated in an increase in the share of the population renting privately since the mid-1980s — a reversal of the long run decline in this share since World War II.

- Once considered a short-term form of tenure for young people, more families with children are renting nowadays, and they are renting for longer periods.

- However, there are concerns with vulnerable private renters, most of whom have low incomes.

- More than 1 million low-income households (2.65 million people) rented in the private market in 2018, a figure that has more than doubled over the past two decades.

- Many vulnerable private renter households struggle with rental affordability. Two-thirds spend more than 30 per cent of their income on rent — the commonly used benchmark for identifying 'rental stress' — and many spend much more. 170,000 households have less than $250 available each week after paying rent.

- Many households experiencing rental stress successfully escape within 12 months, generally through securing higher paid work. However, others are becoming 'stuck', with about half of these households still experiencing rental stress four years later.

- While renting privately offers flexibility — desirable for many — moving involuntarily can be disruptive for low-income households, families with children, older people and people with a disability. It can heighten the risks of financial hardship and homelessness, especially if little notice is given.

- The overall success of the private rental market in responding to the different forces at play highlights the need not to stymie the responsiveness of rental housing supply with unnecessary taxes or overly stringent regulations.

- Commonwealth Rent Assistance has proven to be effective in supporting low income and low wealth households (including retirees) that do not own their own homes. However, maximum payment rates have fallen behind average rents over the past two decades.

- Some state-based residential tenancy laws could do more to improve certainty of tenure for vulnerable tenants. For example, there are wide disparities across the country between the minimum notice periods required for eviction on sale of a property, from as little as four weeks to more than eight weeks.

Affordability is the key challenge for a growing number of vulnerable private renters

Private rental market affordability has remained steady in Australia, but there has been a rapid rise in the number of low-income renters.

A Productivity Commission report found the private rental market works well for many of the 6.3 million people renting, with rent paid compared with income steady, and the supply of rental properties increasing by more than one million over the past two decades.

But the number of low-income households in rental stress has doubled in the past two decades.

"Increasingly, we see families stuck in rental stress. We found that over 600,000 households are in rental stress, that is, they spend more than 30 percent of their incomes on rent. Of these, around 170,000 families have $35 a day or less left for all their other expenses after paying rent," Commissioner Jonathan Coppel said.

"More low-income households rent privately than ever before, in part because home ownership and public housing have become less attainable," Commissioner Jonathan Coppel said.

Half of households who experience rental stress successfully escape within 12 months, generally through securing higher paid work. But, the other half still experience rental stress four years later, the report found.

"Poor rental housing outcomes are a key driver of disadvantage. There has been a lot of discussion lately about whether income support payments are high enough."

"The role of Commonwealth Rental Assistance in addressing disadvantage has not really been part of those conversations and there is merit in looking at whether raising the level of rental assistance would be effective," Commissioner Coppel said.

The report found that more families with children are now renting, as well as people with a disability and retirees.

"Around 1 in 5 moves are involuntary, often as a result of the landlord selling their property, and the costs of eviction can be particularly high for vulnerable households. Having 30 days to find new accommodation if you are elderly or have family responsibilities can be very difficult," Jonathan Coppel said.

The Productivity Commission report Vulnerable Private Renters: Evidence and Options can be found at: www.pc.gov.au/renters

- Cover, Copyright and publication details, Contents, Acknowledgements, Abbreviations and Glossary

- Key points

- Overview

- Findings

- Chapter 1 Setting the scene

- 1.1 The private rental market is growing and changing

- 1.2 The stakes are high when designing policies that affect vulnerable renters

- 1.3 What this paper is about

- Chapter 2 Vulnerable renters: patterns and trends

- 2.1 Identifying vulnerable private renters

- 2.2 How vulnerable are private renters?

- 2.3 Disadvantaged people are increasingly renting in the private market

- Chapter 3 Rental affordability

- 3.1 Rents in the private rental market have moderated following a period of strong growth

- 3.2 Rental affordability is poor for many in the private rental market

- 3.3 Increasing numbers of households experience rental stress

- 3.4 Rental stress in the private rental market has become more persistent

- Chapter 4 Housing tenure and quality

- 4.1 Certainty of tenure

- 4.2 Dwelling quality — size, condition and location

- Chapter 5 Selected policies to assist vulnerable private tenants

- 5.1 Institutional investment may improve certainty of tenure, but would require large tax changes

- 5.2 Commonwealth Rent Assistance is the clearest path to improving affordability

- 5.3 Residential tenancy laws should give vulnerable renters greater certainty

- Appendix A Consultations

- Appendix B Supplementary information

- References

Download chart data

Printed copies

Printed copies of this report can be purchased from Canprint Communications.

Publications feedback

We value your comments about this publication and encourage you to provide feedback.